Law has always been one of the most sought after courses in Australia. Especially the students who find their niche within the boundaries of Taxation law have great career prospects in store for them. This is the reason why there has been a steady increase in the number of students studying Taxation law in their universities. Having said that, there are a number of back-breaking Taxation law assignments that are designed to test their command over a variety of legislation procedures involved in the cases.

One of the most common forms of assessments that students get to complete in this field is the case studies. If you’re a student enrolled in CLWM4100, you already know what we are talking about, don’t you? You might have already come across a plethora of law case studies to write. Being a law student, it is obvious that you are well-versed with all the technicalities that these assignments entail. Not to worry, as our tax law assignment help experts are here to share your academic burden so that you can focus more on gaining a wider understanding of the practical aspects of the law.

In Australia, the most common forms of taxation are the income taxes that people pay. The Federal government of Australia is allocated the responsibility to collect the taxes. As compared to other countries in the world, Australia has a significantly lesser burden of taxes on the citizens.

The Kaplan Business School in Australia is a reputed institution that offers several courses to students, this being one of them. Have you got a CLWM4100: Yvonne Merrick case study assessment answer to write? Just bring it to us, as we will do all our bit to furnish you with instant reference solution for the same. But before that, let us understand what this course has in store for you.

How To Write CLWM4100: Yvonne Merrick Case Study Assessment Answer Just Like Our Experts Do?

Since 2010, our tax law assignment help experts have conducted extensive research in this field so that none of the queries of students could go unanswered from our end. Being thorough with all the intricacies of this case study, we know exactly how to write CLWN4100 law case study assessment answer and secure the grades that you have always aspired for.

Do you get perplexed on writing the solution to this assessment file? Don’t worry, just sit back and have a look at the following excerpts that are from the solution of the case study that was done by our prolific law experts for the reference purpose of students.

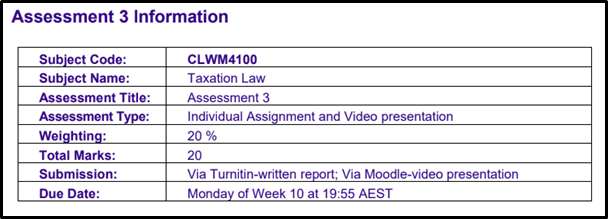

As you can see in the image above, the main objective of this CLWM4100 taxation law assessment 3 is to complete the given case study assignment by analysing the given case study and then answering the question. It is an individual task that revolves around the crucial concepts revolving around Taxation law in Australia. Let us see how our tax law assignment help experts approach this assignment file for the reference purpose of students.

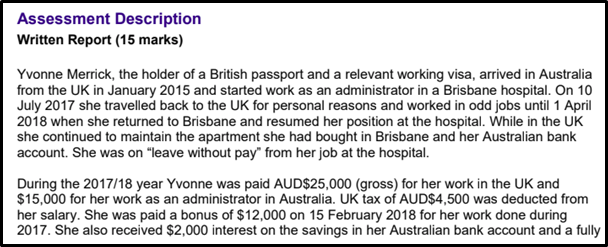

This is the assignment description that we received from the students. The first step is to study the given case study. After this, our law assignment writers perform the tasks that need to be done for this assignment.

Firstly, our experts calculate the Australian assessable income within the time span of 2017-19. For this, we refer to the legislation given in the case to find out the residency of the client. Also, our tax law assignment help writers mention all the reasons why they included or excluded the relevant receipts.

Then, the next task in this CLWN4100 law case study assessment answer is to give advice to Yvonne, in the context of foreign tax that has been paid in the year 2017-18. The main thing that needs to be done here is to determine the tax offset amount.

Points To Keep In Mind While Writing This CLWN4100 Law Case Study Assessment Answer

For writing this assignment, our academic writers pay attention to some of the most crucial aspects of this law case study assignment. Over the years, we have gained a comprehensive understanding of all the vital concepts involved in these case studies, which is why it doesn’t take more than a few moments for us to understand the given cases and accordingly formulate the CLWN4100 law case study assignment solution.

Hence, before you begin writing the solution to this case study or any other similar tax law case studies, make sure you stick to these points and incorporate them into your work to make them error-less.

- Do not exceed the word count for this assignment, which is approximately 1000 words.

- While researching for the case study, make it a point to only rely upon a wide range of tax resources. In this step, our tax law assignment help experts survey relevant literature that is credible and authentic. Some of these include a variety of decided cases.

- Each of the questions that are asked in this CLWN4100 law case study contains certain facts and issues. So, identify them and then apply the most suitable legislation or any other law that fits in the situation. This will help you reach the solution of the problems with ease.

- All the recommendations that are made for the case must be centred upon strong issues that not just fits in the specific case, but also can be applied in similar types of cases.

- Our tax law assignment help experts never forget to give due credits to the author from whose case histories we have extracted information from.

These are some of those points that make each of our solutions impeccable and fetch students the grades that they desire. Therefore, stick to these points and accordingly begin searching for the solutions. Definitely, you would not come to terms with any issues.

If you still get stuck at any point, you can simply bring all your assignment-related problems to us. To make it even easier for you, we are available 24*7 at your disposal to furnish you with instant answers via the live one-on-one sessions. You can even ask us for samples and we would be happy to help you with all the answers!

How Our Tax Law Assignment Experts Help Students In Moving Ahead By Clearing All Their Doubts?

In the last decade, we have come across a wide plethora of case studies in different branches of law. However, among them, writing CLWN4100 law case study assessment answer is one of the most tedious tasks for students. Realising this, our law assignment help experts have always been on their forefront to assist students with guidance on these assignments instantly. In addition to the high-quality work that students get from us, we have already made it a point to cater to all the requirements of students in the form of lucrative perks to enhance their experience with us.

To know more about them, you can have a chat with us via the live one-on-one sessions 24*7, as per your convenience.

Related Study Materials

Our Experts can answer your Assignment questions instantly.

Ask Question0 Comment

Get It Done! Today

1,212,718Orders

4.9/5Rating

5,063Experts

Loved reading this Blog? Share your valuable thoughts in the comment section.

Add comment