The recent years have been quite challenging due to the covid crisis, and no doubt 2022 will offer some severe challenges, all the same - for most of the world's population. As we resume to battle the COVID-19 pandemic, industries were also met with many additional challenges; increasing cyber-attack episodes and intense weather events have resulted in trade interruptions due to team shortages and troubles in the supply chain.

These problems remain unmoving in the near future as we look forward to another year of apprehension. Effective risk management is essential for businesses varying in shape and size to equip for what lies ahead. But, what exactly is enterprise risk management? Is it any different from the traditional risk management methodologies? Is it effective?

If all such questions arise in your mind, don’t fret. In this blog, we will discuss all such concepts and go over a few enterprise risk management examples that will help you understand them better.

Difference between Enterprise Risk Management and Traditional Risk Management

Risk management can be defined as assessing, analysing, and managing risk factors that can affect an organisation's financial performance or security. The circumstances that may cause a threat to the company's processes are generally termed risks. For example, the IT department of an organisation focuses on eliminating all technological risks - viruses, malware, server breakdown, ect.

When developing daily strategies, risk management considers important challenges in the sector, such as protecting patients and reducing healthcare costs. Because these are real-life issues that every treatment centre faces, risk control is purchasing insurance to protect the healthcare service in the event of an error.

On the other hand, traditional risk management is concerned with managing risks for circumstances that have happened before or circumstances that are a common occurrence. It is primarily concerned with exposure and losses generated by a hazardous circumstance or risk factor. TRM does not necessarily include risk involving business management and function. Rather it prioritises health and safety management, insurance and recovery.

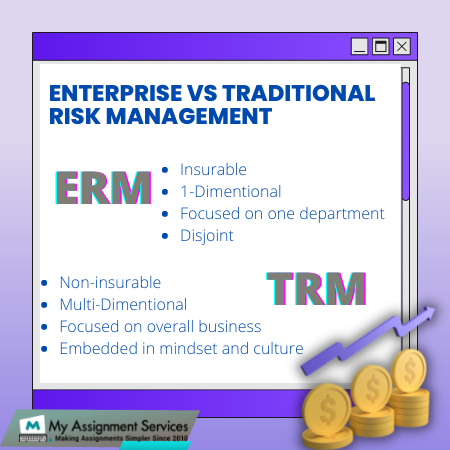

A few other differences between both risk management types are:

- In traditional risk management, organisations generally focus on entities that can be ensured. On the other hand, enterprise risk management, for example, is useful for things that cannot be insured and are more improbable; data breaches are an example.

- TRM strategies are one dimensional, employees' health insurance, financial recovery, ect. But, ERM strategies are more concerned with finding the root of the issue and hence, have multidimensional strategies.

- When an adverse situation occurs, TRM comes in handy as it is designed to deal with situations that have happened before. ERM is proactive and suited for managing bigger issues that may arise in the future.

- The need for traditional risk management arises when an adverse situation arises in a business environment, but enterprise risk management is deeply ingrained into developing new strategies and ingraining them into a lifestyle and daily tasks.

As the world is evolving, so are the risk management strategies. Various "traditional" management methods and activities will likely get automated soon, during the fourth industrial revolution. Being on par with the change and improving risk management techniques for the company's success is necessary, and it will be more prominent in the future.

Working through your assignments will require you to go through the various stages of researching, drafting, compiling your research papers, ect. It can get overwhelming to do all of it, get management assignment help to get free resources and affordable live guided sessions. Our experts can help you throughout the process of compiling your assignment.

Learn how to acknowledge any source of information using the APA 7th style.

Download Now

What are the Various Types of Enterprise Risk?

Risk management also results in cultural changes as it is ingrained in lifestyle and everyday tasks, like the 'caution floor is wet' sign the janitor put while cleaning. Yes, risk management can be as minor as a signboard or the expiration dates on products. Its purpose is to access and avoid any adverse situation.

According to a survey released by McAfee in 2017, cybercrime costs approximately $600 billion each year. It might be as much as 1% of the overall GDP. Hacking has resulted in enormous losses for major corporations.

There are various forms of enterprise risk management depending on the need and strategies; here are a few enterprise risk management examples:

1. Hazard Risk Management

Risk management concerning Occupational safety and health (OSH) is useful for determining hazards, risks based on the possible severe work injuries, bad health and possession damage, prioritising the execution of measures to prevent these risks and conveying the risk management procedure to the employees.

2. Internal Control

It is yet another method of ensuring that the meta-processes at companies monitor internal processes' compliance. Internal management processes also improve efficiency in conduct, unity, and all-around processes. Larger businesses, particularly those highly centralised, often have intricate and extensive internal governance systems.

3. Internal Audits

Such audits are useful for ensuring that the internal rules are operating properly. It is little different from hazard management – it’s a meta-level strategy that examines the expenditure and efficiency of the ERM processes. Internal audits are designed centred on the risks management practices and how they align with the established policies and techniques of the ERM.

4. Regulatory Compliance

Organisations must follow certain laws and regulations; this enterprise risk management area is concerned with measures to meet such requirements. For example, the requirements for site safety, environmental guidelines, social accountability, or tax payment. Businesses will generally have a compliance unit or manager specifically tasked with the legal interpretation of such requirements, advising, training, and guidance for compliance.

Enterprise risk management systems are not only designed for avoiding risks but rather ensure the proper functioning and compliance in a company. It is useful for preparing for all the things that can go wrong (literally) and, of course, on-spot remedies for certain circumstances that arise at the workplace or organisational levels.

What are the Current Trends in Risk Management?

Enterprises are more interconnected to their partners than ever - vendors, suppliers, and resources worldwide. As Joseph Valente quotes, "When there is particularly more risk in one of the categories in risk management, it may affect the other categories as well". " The effect of a natural catastrophe can disturb or even break an entire global supply chain.

The only way to achieve ERM excellence is to work as a team. Every person in the organisation, from the most prominent to the bottom of the hierarchy, gets involved. Because every aspect of the company is vulnerable, all should be on board.

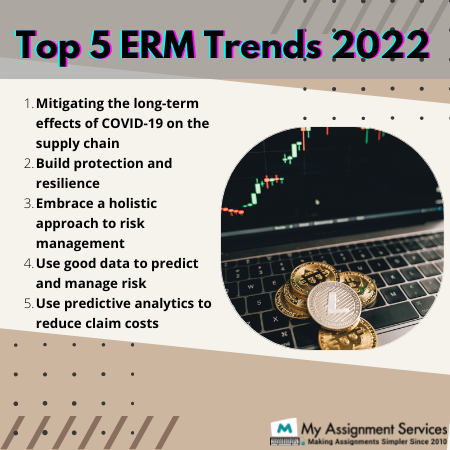

These are a few enterprise risk management examples and trends that are redefining the risk topography and impacting business:

- The technology for actively evaluating and minimising hazards is improving. Internal and external risk detection systems are among the enhancements that aid in the generation of hazard intelligence that recognises trending and developing hazards.

- To deal with the interruptions created by the COVID-19 epidemic, businesses are prioritising resilience over risk assessment.

- Enterprise Risk Management now includes security, Information Technology, third-party partnerships, governance threat, and accountability, in addition to financial control.

- A risk maturity approach is being considered by more businesses as a strategy to manage the rising interconnection of liabilities in the risk environment.

- Gathering all the risk data is essential, but professionals are also needed to interpret it. Businesses are continually relying on the management, risk, and regulatory platform to build a knowledgeable ecosystem of experts in the field for crucial initiatives.

One thing that organisations can do right now plans forward and create risk management processes. 2022 is not the year in which trust risk management can be left to chance; businesses need a collaborative effort and professional guidance on what they need to do now to secure their processes.

We offer a live guided session for students at affordable prices; you can enrol by filling out the enrollment form and connecting to one of our experts. It's that easy and accessible. Get management assignment help that doesn't compromise your learning experience; rather, upgrade it with our experts and score HD.

Related Study Materials

Our Experts can answer your Assignment questions instantly.

Ask Question0 Comment

Get It Done! Today

1,212,718Orders

4.9/5Rating

5,063Experts

Loved reading this Blog? Share your valuable thoughts in the comment section.

Add comment