You might compare the balances of the cash on the balance sheet to the matching total on your bank statement, detect the differences between them, make modifications to the accounting documents, correct any errors, and discover fake actions.

You must reconcile your accounts even if you use bank feeds to conveniently import your bank account and credit card information into your Account. You are reconciling guarantees that your company’s bank account amounts match your bank’s records.

For a bank statement reconciliation, the sum of the account recorded by the bank is contrasted to the general ledger. A cash book is used to keep track of both bank and cash transactions in a business. The cash column represents the accessible cash, whereas the bank column represents the cash at the bank.

Therefore, each consumer holds a bank account. The deposits are documented on the credit side of the bank’s books, whereas withdrawals are documented on the debit side. Consumers get their account statements monthly or at periodic intervals from the bank.

These balances don’t always match. The company must determine the cause of the discrepancy and reconcile the variances. This is done to ensure that all items have been documented and that the last balances are correct. A bank reconciliation statement often referred to as a reconciliation statement, is created to do this.

Here’s How You Reconcile a Bank Statement: Comprehensive Guide

Assume that the bank sends you a bank statement once a month, usually at the end of the month. The statement details the cash and other deposits that are written into the company's checking account. Furthermore, bank charges like fees for account servicing are also included on the statement.

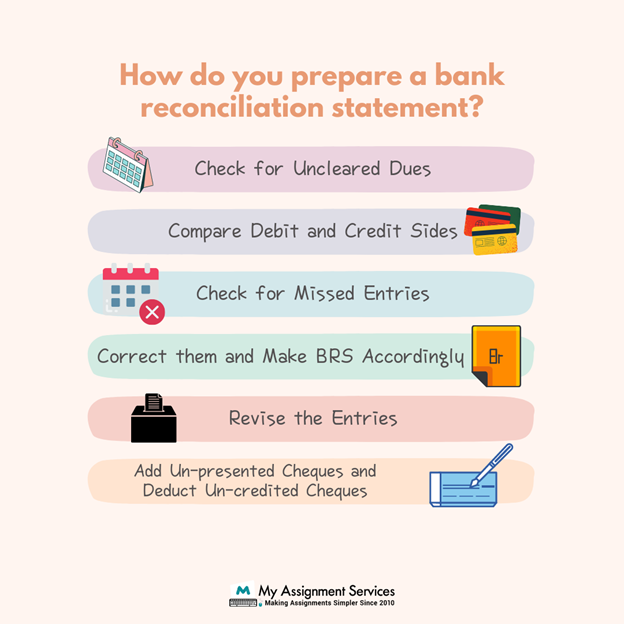

To Reconcile A Bank Statement After You Get It, Do Follow These Steps:

Deposit Comparison

Make a distinction between the deposits on your bank statement and the deposits in your business paperwork. From the debit side of the bank's cash book to the credit side of the bank statement, calculate the amount of each deposit. The credit side of the bank statement, as well as the debit side, are both available. Make a list of what the two records have in common and what they have in common.

Bank Statement Adjustment

To establish the revised balance, make the appropriate adjustments to the bank statement balances. Add up the deposits in transit, deduct outstanding checks, and add or subtract bank faults to arrive at this figure.

Deposits in transit relate to money collected and documented by a business but not yet documented by a bank. All of this information should be included in the bank statement.

Outstanding checks are checks that were written in the business's cash account but have not yet cleared the bank account. They must be deducted from the balance in the bank account. This happens a lot in the last few days of the month when checks are written.

Bank faults are inaccuracies committed by the bank during the creation of the bank statement. When you enter an inaccurate amount or an amount is missing from the bank statement, those are both common mistakes. To find the inaccuracies, compare the bank statement to the general ledger of the cash account.

Cash Account Adjustment

In the company’s account, the cash balance must then be modified.

Put interest to the cash balances in the business account, or subtract monthly charges and overdraft fees.

Businesses must account for bank fees, NSF checks, and accounting errors in order to do this.

- Bank costs are fees and service charges charged by the bank for executing the checking account activity of the company. This could include monthly fees or fees incurred as a result of an account overdraft. They must be taken out of your bank account. Any interest generated on the bank account balance shall be transferred to the cash account.

- When there are faults in the cash account, an inaccurate sum is recorded, or an amount is missed from the records. The cash account in the books will get high or low as the error is corrected.

- A check which the bank returns because of inadequate money in the entity’s bank accounts is known as an NSF check. This means the check amount has still not been deposited into your bank account and should be deducted from your cash account records.

Balance Comparison

The updated amounts must be the same after adjusting the balances according to the bank and the books. You’ll have to repeat the reconciliation process if they’re still not equal.

Once the balances are similar, businesses should create journal entries for the changes to the sum per book.

You can use the Bank Reconciliation tool to:

- Examine the receipts and payments that have been recorded in the ledgers and cash register.

- Compare your bank statements to the receipts and payments you've made.

Before reconciling your bank and other data, you can pick several receipts from Bookkeeping Bank Reconciliation.

- On the main menu, go to Bookkeeping > Bank Reconciliation. The page for Bank Reconciliation appears.

- Choose a company from the drop-down menu.

- Choose a bank account from the drop-down menu.

- If needed, update the current default date in the Date to the field.

- Choose a date from the drop-down calendar or enter it in the format dd/mm/yyyy.

- In the Statement Balance area, enter the amount on your statement. The difference between the Statement Balance and the Reconciled Balance fields is displayed in the Reconciliation Difference field.

- Consider the following statement:

- Choose each receipt or payment in the statement, which is also shown in the table.

- Select the receipt with the [Space Bar] and input it in the Receipts Ticked and Payments Ticked sections. The assertion is confirmed. Hence a C is displayed in the item row.

- To delete the C, press the [Space Bar] once again.

- Click OK to complete the reconciliation and close the Bank Reconciliation page, or close the window without saving your changes by clicking Close.

Frequency of Bank Reconciliation

Typically, you might reconcile your bank account immediately when you get a statement from your bank. Companies with a high amount of trading will regularly do this at the end of the month or every day.

Make sure you’ve logged all of your transactions up to the bottom of your bank statement when you start the reconciliation process. Companies that utilise online banking services can receive bank statements for regular reconciliation rather than physically inputting the information.

Bank Reconciliation’s Purpose In Myob

The bank reconciliation procedure has a number of benefits, including:

- Problems like multiple payments, calculation errors, skipped payments, and so on are detected.

- Keeping track of penalties and bank fees recording them in the books

- Fake transactions and theft are easy to spot.

- Keeping track of the business's payables and receivables

The Bottom Line

Bank reconciliation in Myob via accounting software is more convenient and fault-free. The bank transactions are automatically transferred, allowing us to match and categorise many transactions quickly. The procedure becomes more efficient and manageable as a result.

Well, we now know understanding bank reconciliation for Mycob assignments is a tough task to do, and in most circumstances, you will need proper guidance. To simplify the process, My Assignment Services has introduced finance assignment help in Australia. Now you can have access to top-notch mentors who will resolve all your doubts. To begin, simply fill in the form with your query and upload the assignment question file. One of our representatives will get back to you in the shortest time.

Related Study Materials

Our Experts can answer your Assignment questions instantly.

Ask Question0 Comment

Get It Done! Today

1,212,718Orders

4.9/5Rating

5,063Experts

Loved reading this Blog? Share your valuable thoughts in the comment section.

Add comment