Industry knowledge is defined as the industry-specific information to help understand the special terms and market conditions of a certain type of loan. The more you know about your client's business, the better able you are to offer them appropriate solutions, no matter their needs. For example, if your client needs working capital to finance inventory, understanding inventory management best practices can help you determine an appropriate solution (and price).

The lending process is a systematisation method for the loans approval process. It has three steps: pre-approval, proposal evaluation, and final review before making a lending decision. Industry knowledge and lending processes will help you determine your clients' lending decisions. Lending and Industry knowledge can be complicated to understand.

How Important Is Industry Knowledge?

Industry knowledge and the lending process is important for students like you. Students do not have the experience to run a business, but they are very ambitious and enthusiastic about starting their own business or planning to open a franchise. Most students lack working capital because of their limited credit history. Students will need loans for various reasons, such as establishing their own business, taking care of initial expenses such as rent deposit utility, looking for internships and applying to university, travelling abroad for further studies, joining training courses, etc. It is very difficult for these students to find loans with favourable conditions. But if they have industry knowledge, they can guide themselves better on getting funding made available for their needs.

Is it Required or Can it be Improvised?

Industry knowledge and lending processes are the two main components of an effective lending process. If both are kept in mind while making any loan decision, the chances of reducing the default rate will increase significantly. For example, a student who wants to open his own business may not have sufficient credit history for obtaining a credit card or personal loan from the bank. However, he could still qualify for this loan if he has proper industry knowledge and understanding of market conditions and has a stable revenue source for paying back the loan.

How Do you Go About Abtaining Industry Knowledge?

Industry knowledge is gained by listening to clients' requests and learning from their needs. You will gain this through your experience in a real working environment or your course curriculum. For example, suppose your client wants to open his own business but doesn't have sufficient credit history. In that case, he may try to apply for loans with favourable conditions such as a 0% interest rate over a 3-5 years repayment schedule. You can advise him that there is no free lunch in this world. Even though banks offer these attractive terms, these loans are risky because of the lack of collateral security provided by the borrower against the loan amount given by the bank.

What Are the Things to Be Kept in Mind While Dealing With Clients?

A good Lender must have the following skills:

Good Listener – To understand what your client is looking for. Analytical Thinking- Ability to analyse various options and suggest the most beneficial for your client.

Problem Solver – If your client faces any constraints, you as a lender should decide on alternative financing options to solve those problems.

Written and Oral) - You may need to send or receive information by fax/email/letter etc., so you must know how to communicate politely but assertively in writing and verbally.

Negotiation Skills– The ability to get the best deal possible from the other party means giving up less (or even nothing) and getting more.

Learn how to acknowledge any source of information using the APA 7th style.

Download Now

What Are the Steps Involved in the Lending Process?

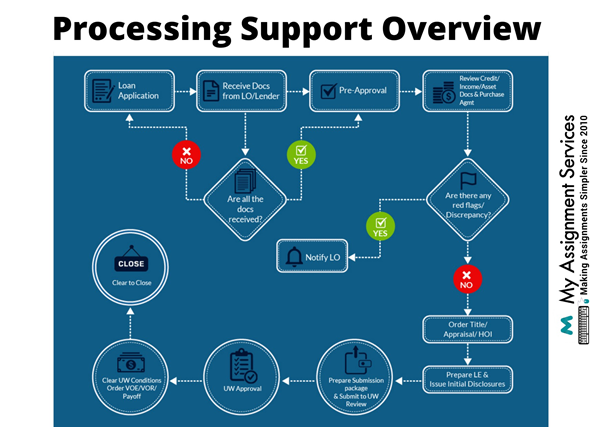

The lending process is a systematisation of the lending process. There are three steps involved: Each step has its own guidelines for performing its task within the agreed time frame and expectations from the lender's side to prepare reports/documents as per boundaries set by the company (or lender).

Pre-Approval – Here, you need to decide if your client qualifies for the loan or not based on the assessment criteria that you have laid down. You may also decide whether you can offer this product or not. If your client qualifies, you will issue him a letter of pre-approval that states the amount, tenure and other general terms of this loan. He will draft a proposal form that you will use while submitting it to your own company for the further evaluation process.

Proposal Evaluation - If your client requires financing against contracts or invoices, his proposal must fulfil set conditions. You need to assess his proposal (involving risk analysis) based on internal policies laid down by your lender's company. For example, if the IRR (Internal Rate of Return) is too high, then the risk associated with the project is very high; if the repayment schedule is stretched out, then chances are clients might miss payments; or if you see any discrepancies in the paperwork required, these factors must be corrected before submission for a final review because these might lower the company's liquidity ratio.

Final Review - During the final review, you must conduct due diligence (DD) by carrying out a detailed investigation of clients' financial statements, industry fundamentals, type of business etc.; this will show the exact financial position of your client and help the overall evaluation process to decide whether this proposal should be accepted or declined. If it is declined, then the reason for the rejection must be communicated right away to the applicant

What Are the Different Types of Lending?

There are mainly four types of lending:

Operational Working Capital – This is an instrument used by companies to manage their day-to-day financial requirements related to production/trading activities. For example, purchase of raw material, supplies or labour payroll.

Project Financing - Lenders provide finance against specific projects with high growth potential for gaining a good return on investment over a specified period of time, e.g., setting up new factories, building infrastructure etc.

Term Loans – The loan provided under this scheme can be either short term (less than 1 year) or long term (more than 1 year). These funds are allocated either against fixed assets or working capital requirements depending on the requirement decided by the company.

Bridge Financing - This is used to meet short term requirements of a business, e.g., purchase of equipment, plant & machinery etc. These are short term loans that companies secure for meeting emergency financial needs with high-interest rates because of shorter repayment periods (up to one year).

The Greatest Ever Finance Assignment Help Is Here!

For any borrower, the decision to get a loan is never easy. But once you get it, certain terms and conditions apply. He must go through these documents before signing them. If he ends up agreeing to something that was not his intention, this might backfire in the future on his business or even personal life. Today, as the lending market has grown, its players have realised the need for standardisation. This is possible only if lenders & borrowers agree on a common set of guidelines defining their roles and responsibilities, which will help to streamline the lending process. As per my view, if implemented properly, these guidelines will give lenders a clear idea of what kind of business they are taking from borrowers. This will surely protect their interest if the borrower runs out of business.

We're here to help you with your finance assignment. You deserve a break from the stress of college, and we want to be there for you. As always, if you have any questions or need help with your next assignment, please do not hesitate to reach out to us. Experts at My Assignment Services are here to provide you with finance assignment help sessions in no time! Fill out the form now.

Related Study Materials

Our Experts can answer your Assignment questions instantly.

Ask Question0 Comment

Get It Done! Today

1,212,718Orders

4.9/5Rating

5,063Experts

Loved reading this Blog? Share your valuable thoughts in the comment section.

Add comment