- Subject Code : 200537

- University : Western Sydney University My Assignment Services is not sponsored or endorsed by this college or university.

- Subject Name : Economics

Economic Outlook of Australia

The current state of monetary policy and economy outlook

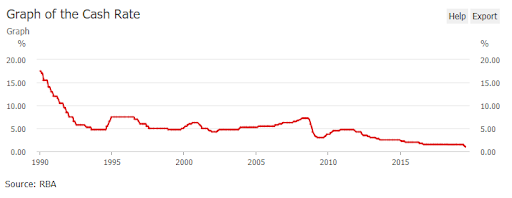

Before discussing the monetary policy of Australia, an important concept of Cash Rate must be discussed. Monetary policy choices are conveyed as a cash-rate goal, which is the overnight interest rate on the monetary sector. The Reserve Bank of Australia's significant benchmark interest level depending on its inflation goal charged on overnight borrowing between economic institutions is termed as cash rate, while according to the Reserve Bank of Australia (2019a), the current cash rate is 1%.

Fig.1: Cash Rate Australia; Source: https://www.rba.gov.au/statistics/cash-rate/

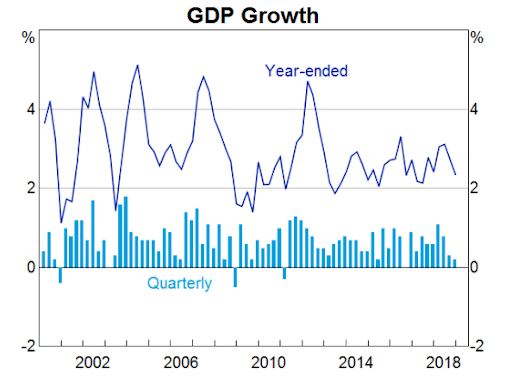

Economic circumstances relate to a nation or region's current condition of the industry. In Australia's economic growth was softer than anticipated in the February Declaration in 2018. Over the previous three months’ new data has resulted to further downsizing of the GDP development and inflation perspective. Overall, over 2019 and 2020, GDP development is anticipated to be around 23⁄4% (Reserve Bank of Australia 2019b).

Fig.2: GDP growth of Australia; Source: https://www.rba.gov.au/publications/smp/2019/may/economic-outlook.html

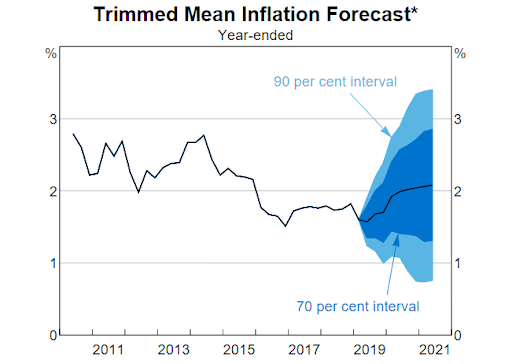

Effect on inflation

Inflation underlying this will rise by 2% by the beginning of 2020 and will rise slightly more by the middle of 2021.

Fig.3: Inflation Forecast; Source: https://www.rba.gov.au/publications/smp/2019/may/economic-outlook.html

Effect on Housing

Consumption in the next few quarters is anticipated to stay fragile due to low disposable family revenue development and poor housing market circumstances in recent years. According to a report by Reserve Bank of Australia (2019c), consumption development is anticipated to rise by 2% in 2019 and then to 23/4% by mid-2021, backed by increased disposable earnings development and a pull away from the circumstances of the residential industry.

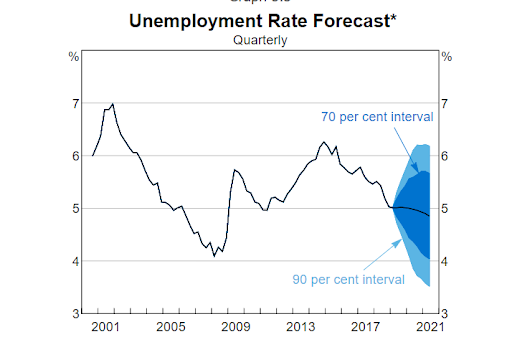

Effect on unemployment

It is anticipated that the unemployment level will last some time before falling to 43⁄4% by mid-2021 (Figure below). This indicates, although there is continuous uncertainty in its scope, that there will continue to be some reparable ability in the labour market in the coming years.

Fig.4: Unemployment Forecast; Source: https://www.rba.gov.au/publications/smp/2019/may/economic-outlook.html

Effect on interest rate

The bank hacked its development prediction from 2.5% to 1.7% over the year until June – its prediction as late as November was 3.25% (Economic Outlook 2019d).

References

Reserve Bank of Australia. 2019a. Cash Rate. Available [online] at:

https://www.rba.gov.au/statistics/cash-rate/

Reserve Bank of Australia. 2019b. GDP growth of Australia. Available [online] at:

https://www.rba.gov.au/publications/smp/2019/may/economic-outlook.html

Reserve Bank of Australia. 2019c. Economic Outlook. Available [online] at:

https://www.rba.gov.au/publications/smp/2019/may/economic-outlook.html

Reserve Bank of Australia. 2019d. Economic Outlook | Statement on Monetary Policy. Available [online] at:

https://www.rba.gov.au/publications/smp/2019/may/economic-outlook.html

Get It Done! Today

1,212,718Orders

4.9/5Rating

5,063Experts

Highlights

- 21 Step Quality Check

- 2000+ Ph.D Experts

- Live Expert Sessions

- Dedicated App

- Earn while you Learn with us

- Confidentiality Agreement

- Money Back Guarantee

- Customer Feedback

Just Pay for your Assignment

Turnitin Report

$10.00Proofreading and Editing

$9.00Per PageConsultation with Expert

$35.00Per HourLive Session 1-on-1

$40.00Per 30 min.Quality Check

$25.00Total

Free- Let's Start