- Subject Code : SM0269

- University : Northumbria University My Assignment Services is not sponsored or endorsed by this college or university.

- Subject Name : Business

Assessment

Contents

Part 1: Porter’s National Diamond Analysis

Introduction

1.0 GOVERNMENT

1.1 Government Positive

1.2 Government Cons

2.0 FACTORS

2.1 Factor pros

2.2 Factor cons

3.0 CHANCE

3.1 Chance

3.2 Chance Negative

4.0 DEMAND

4.1 Demand

4.2 Demand cons

5.0 RELATED AND SUPPORTING INDUSTRY

5.1 Related and Supporting Industry

5.2 Related and Supporting Industry Negative

6.0 FIRM STRATEGY, STRUCTURE AND RIVALRY

6.1 Firm Strategy, Structure and Rivalry

6.2 Rivalry strategy

6.2.1 Service Provides

6.2.2 Data

6.2.3 Retail

6.2.4 Distributor

Part 2: Foreign Direct Investment Market Entry

2.1 Acquisitions

2.1.1 Advantages of acquisitions

2.1.2. Types of acquisitions

a) Cash Acquisitions

b) Stock Acquisitions

2.2 Greenfield

2.3 Recommendation

Part 3: Risk Management

3.1 Issue of unemployment

3.2 Issue of FDIs

4.0 Reference

Part 1: Porter’s National Diamond Analysis

Introduction

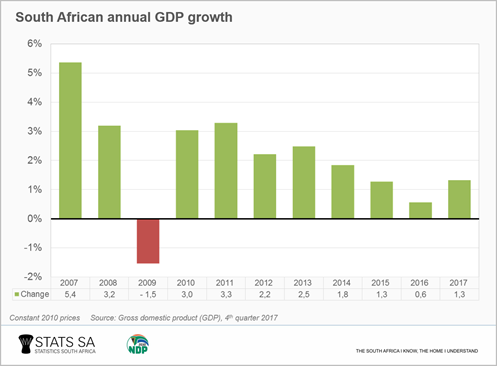

This report is going to analyse the attractiveness of new business opportunities in telecommunication in South Africa as an investment opportunity for a consultant company which is approached by a European company. The focus of the analysis of the overall competitiveness and investment attractiveness in South Africa analyses using porters National diamond as a framework for assessment. South Africa has a population of about 55.7 million is the largest economy in Africa. According to the World Bank, it is the world 28th largest economy with an upper-middle-income economy, and since 1994 their economy has been increasing at an average rate of 3.3% with GDP SA grew 0.8%. (STATS SA, 2018).

Figure 1

The above figure 1 represents the South African annual growth in the GDP.

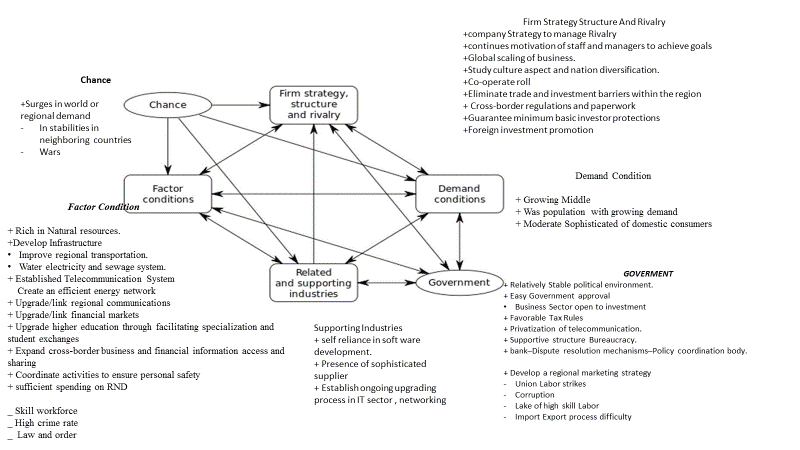

Figure 2

Figure 2 represents an extended version of Porter's diamond model. The framework of Porter's diamond serves as a tool used for the purpose of strategic analysis. This diamond model is used to achieve better insight into how the environment of a company, over time, influences its competitive advantage (Sertyesilisik, 2016). In addition, it helps in analysing the factors which would affect companies' competitive advantage when operating the business on foreign land. The framework consists of four main factors which are factor condition, firm strategy, structure and rivalry, demand conditions, and the related and supporting industries. Furthermore, it also provides two side factors which are government and chance.

1. GOVERNMENT

1.1 Government Positive

The investors find the taxes and customs to be highly favourable to them. The SA tax payment has been categorised into two groups, one is the central government and the other is the local government (SARS, 2019). The government in 2017 announced that they would partially privatise different ‘stage-owned' assets, SA being included. The approval of the government, in this case, is not required. In addition, there are only a few restrictions on how much and how the investments would be done by foreign entities. Moreover, various measures have been put by the government for encouraging foreign investors. This includes investment incentives, simple rules for taxes, and improved regulatory policies associated with the protection and completion of the intellectual properties (Tuomi, 2011). Due to the maturity of the market, the entry to the market has become competitive. The SA political system can be considered to be the most stable one when compared with other regions in Africa. The democracy in SA is established while the laws and rules are monitored. Ramaphosa leads the new ANC administration. It is expected that this administration would encourage foreign investors more than Jacob Zuma (previous president) (UNCTAD, 2018). The economic reforms in the country are well placed which results in stability on macroeconomic aspects (Manolova, Eunni & Gyoshev 2008; Urban, 2018). Due to the sudden increase in the businesses and tourism in regions like Cape Town, Durban & Johannesburg, international airports have been developed to facilitate the growth. In SA, the law is primarily regulated via the Electronic Communications and Transaction (UNCTAD, 2018).

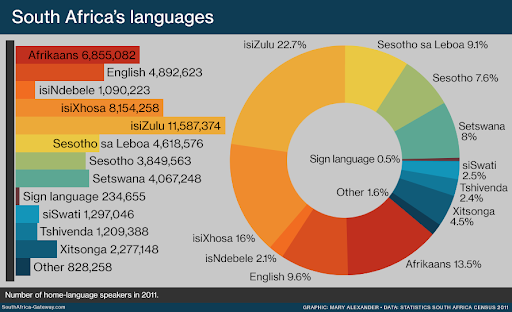

Figure 3: South African language

Figure 3 represents the different official languages spoken in SA with English being the most spoken one in public life for commercial purpose. It is however at 5th position when considering languages spoken at home.

1.2 Government Cons

One of the major issues in the SA is unemployment with one out of every four persons is unemployed. The nation requires a skilled workforce having technical knowledge as there are great opportunities for the mobile telco (Hodge, 2000). The main concern for investors is the lack of highly-skilled labours for their projects. In addition, foreign workers' employment is complicated due to strict immigration laws. SA faces difficulty in management due to the increased strikes by the labours, especially in recent years. This may lower the credit rating of SA in front of the world (Cock, 2015).

Violence and corruption in SA have been a constant worrying factor. With the lack of a skilled workforce and highly stringent laws of labour immigration along with difficult import and export procedures, the investments in the country suffer. Over 102,700 people have emigrated in the last ten years before 2016, while most of them being skilled in different areas. Insufficient supply of skilled labour affects the investments and lack of investment then affects the FDI of the country (Business Tech, 2016).

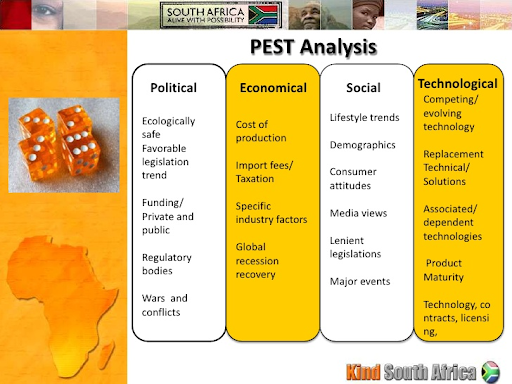

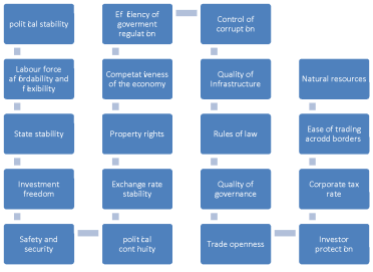

Figure 4: PEST Analysis

The above figure represents the country’s framework using PEST analysis and presents four different areas including political, economic, social and technological aspects of the country.

2.0 FACTORS

2.1 Factor pros

South Africa has an abundance of natural resources such as diamond, crude oil and different minerals (Nwonwu, 2016). In addition, much of foreign capital has seen inflow into the mobile telecommunication sector in SA which results in constant improvements and innovations in the business models and contributes highly towards increasing the competency in the respective sector (Langmia, 2006). It has been identified that primary infrastructure is required in the concerned region to be able to adopt effective telecommunication systems. This includes the government’s dedication and that of the stakeholders, consistent availability and supply of power along with affordable bandwidth.

-

It has been highlighted by many researchers that there are different challenges which impact the ability to adopt telecommunications in an effective manner. This includes the deteriorating infrastructure in the rural regions, ineffective telecommunication links, poor education and negative governance. Moreover, infrastructural requirements such as affordable bandwidth, the commitment of stakeholders and the government along with constant supply and availability of electricity, are required to be met (Kalba, 2008).

-

Roycrofta and Anantho (2003) reported that the loss of rural infrastructure, human capital and economic resources inhibit the potential of the authorities in providing, especially the rural regions, the social offerings. Although SA is considered to be having the better infrastructural capability when compared to other regions in Africa, the adoption of the internet would be impeded by the conditions of the rural areas (Roycrofta & Anantho, 2003).

2.2 Factor cons

Lack of skilled labour force: South Africa's education system is in crisis, the main reason for this being the poor support from the government along with lack of people's awareness. This results in the production of the unskilled workforce (Kyobe, 2011). The problems such as high illiteracy ranges, loss of IT and terrible making plans are not unusual when dealing with South African SME zone. Moreover, the high unemployment rate and lack of education have contributed towards the high rates of crime. In addition, law order monitoring is neglected because of high corruption levels. Furthermore, the lack of investment has resulted in poor electricity access (Olawale & Garwe, 2010).

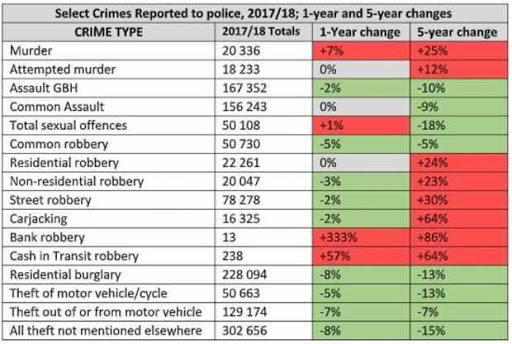

Figure 4 represents the statistic of crime rates for the six consecutive years in the past. It indicates that SA is a county which has one of the lowest safety levels.

Figure 5 Crime reports

-

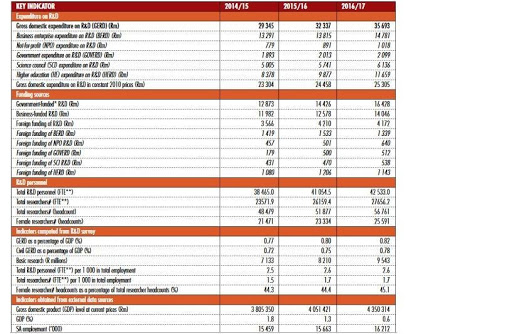

The literacy of the nation in commerce, scientific and technical is limited. The Department of Science and Technology presented the statistics.

Figure 6: Statistics

Figure 5 presents the increase in the expenditure in 2017 by R3.3 billion for the financial year of 2016/2017.

3.0 CHANCE

3.1 Chance

The South African regions have well-established stability as no wars are waging in the neighbouring countries. The defence forces are one of the best while in training aspects it is at the second place with 90,000 troops. Recently, the spending budget on the defence has seen an increment and is now at ZAR50.5 billion. The SA military's relations with the nuclear level weapons were discarded. Moreover, regarding the capacity and acceptance of the new products, these are not affected by the decisions involved in the political business (Helmoed-Römer, 2019).

3.2 Chance Negative

The development in South Africa would impact the global financial market which is based on the exchange rates in the economy, which can vary from time to time. The South African market of telecommunication is stable while there are surges in the demand both globally and regionally. The inequality in income is high whereas corruption and violence still continue to affect the economy. Regarding political stability, it is promoted effectively with the help of a legal system which is sufficiently transparent. Moreover, the country continues to suffer from the issues of increasing social unrest (demonstrations and strikes), high crime rates, structural issues in the logistics and supply of electricity, and high corruption levels. These issues will need to be considered to improve the studies (Rose-Ackerman & Palifka, 2016).

4.0 DEMAND

4.1 Demand

The number of mobile users has been increasing in the South African population. The innovation and product delivery occur at a faster pace because of the pressure on the companies by the middle class which demands sensitive products which are also of high quality. Saleem, Mahmood and Mahmood (2010) discussed the association of intrinsic motivation (perceived enjoyment, perceived ease of use), an extrinsic motivation which involves the perceived usefulness, and demographic (education level, gender and age) with four activities regarding internet usage.

-

Youth indulging in downloading and messaging.

-

The usefulness is perceived as being highly associated with browsing, messaging, purchasing and downloading.

-

Perceived enjoyment and ease of use has been associated with messaging, downloading and browsing services

4.2 Demand cons

In the market, mobile telco is highly competitive. To be able to address the increasing demand, the operators of mobile telco would need to seek innovative approaches to fund projects. The reason for this is that for the investors, high number of competitors pushes the operators towards expansion even if it does not offer growth in terms of profits (Jobodwana, 2009).

5.0 RELATED AND SUPPORTING INDUSTRY

5.1 Related and Supporting Industry

The software development in SA is highly recognised for their innovation in regards to the products which are cost-effective. The software related to networking is developed within the SA region only. The hardware needed for its development is provided by the SA manufacturing industries. Diversification can be seen in the local market businesses in terms of a system of testing and piloting. In addition, for the telecommunication industries, it is an advantage that comparative supplies exist (Chvula, 2013). In addition, there are different technologies which provides a significant support to the industry of telecommunications, one of this is the comm technology. The application of wireless technologies has supported in the transmission of data at a faster rate. In addition, it has allowed the telecommunication providers in becoming more competent with the provision of better access to the internet services. Furthermore, new technologies continue to develop in the wireless companies which support transmission rates which are even faster (Bouwfonds Investment Management, 2016).

Other technology which helps the telco are those which provide data transmission services through cables. The advancements in the fiber optics technology has enabled the transmission of high-quality data at a faster pace with increased reliability. In addition, such cables can be used to provide telecommunication services to different areas especially the rural and remote regions, this improving the customer segment (Bouwfonds Investment Management, 2016).

5.2 Related and Supporting Industry Negative

Due to increased demand for use in the market, the competitiveness of the mobile telco has increased. As a result, new service providers if provided with opportunities to perform in the market would result in decreased profits for the older mobile telco.

6.0 FIRM STRATEGY, STRUCTURE AND RIVALRY.

6.1 Firm Strategy, Structure and Rivalry

The companies oftentimes like to experiment with technology to stay up-to-date with the ongoing technological advancements. They should remain cautious while doing so as even with newer technology the signals could distort. Therefore, it is suggested that proper analysis and strategy making is done before thinking of adopting new technology (Dholakia & Kshetri, 2004). The results in the market would be better if the staff’s operating skills and their knowledge is updated frequently. In addition, it is important they the staff feels motivated to make contributions. Therefore, the global leaders should go through the process of constant monitoring and evaluation of the domestic as well as international market to be able to perform with high excellence. This would involve: -

-

Perform negotiations with respect to the structure of operation and the government policies

-

Evaluate and understand the framework of customer policy for both contractual as well as non-contractual uses

-

Ensure optimum generation of income and planning of new ventures

6.2 Rivalry strategy

Service providers in SA have maintained retail stores while providing varieties in mobile network services.

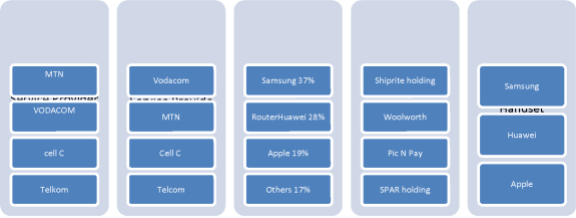

Figure 7 Rivalry strategy

6.2.1 Service Provides

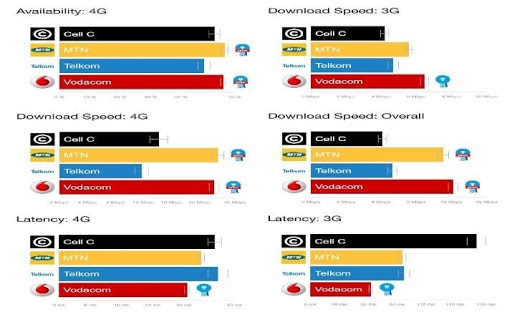

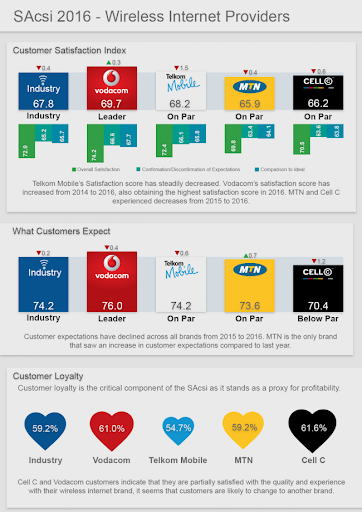

The mobile telco in SA such as Telcom has a high share in the market in their home country, however, Vodacom is performing better than other telecommunication companies. The reason for this is the service they provide is better in terms of a better offer, more data and better speed than other providers. The figure below presents different providers. Better services along with great service quality result in greater satisfaction of the customer, resulting in increased loyalty of the customer towards the services (James, 2011).

Proved in figure 7 & 8

Figure 8: Speed

Figure 9: Internet providers

6.2.2 Data

-

Vodacom offers great network speeds which are preferred more by the users. The customers require services which offer flexibility along with wide coverage range.

6.2.3 Retail

-

Update annual lists of various retailers across different countries provided data of 250 retailers which did business in 32 countries. Compared to other retailers in South Africa, the customer index presented that Woolworths had the best score in providing customer care.

6.2.4 Distributor

Vodacom which is the main network supplier has better support from the mobile distributors as compared to other distributors of telco services.

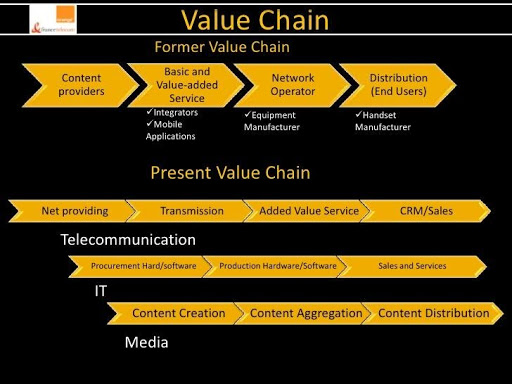

Figure 10: Value chain

Part 2: Foreign Direct Investment Market Entry

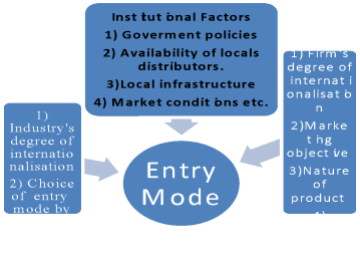

The main factors which influence the foreign direct investment are the institutional factors. There are different nodes for entering the market and to be able to achieve successful entry three categories of investments falling under Acquisitions, Joint Venture, and Greenfield are needed to be followed (Denisia, 2010). The figures 10 & 11 below represent market analysis on the acquisition, investment merging and greenfield. There are two forms, one with different cultures with respect to each other and other than this is subsequent assimilation and accommodation of culture. The concept of the merger is that it involves two or more firms or companies joining together to form a new organisation whereas acquisition process involves the fitting of other firms into a structure that was pre-existing (Alfaro & Chauvin, 2016).

Figure 11: Market analysis

Figure 12: Entry mode

Some of the key important variables which the investors can consider while making decisions regarding investments are presented in figure 12 below: -

Figure 13: Investments

2.1 Acquisitions

2.1.1 Advantages of acquisitions

-

Achieve access to a market which is established

-

The technology along with their clients and vendors are acquired instantly

-

Negotiation happens at top levels

-

One less competitor for the investor to deal with

-

The knowledge base of investors increases

-

Just like mergers acquisitions can be divided into three categories. As per Buckley et al. (2010) there are several types of the acquisition on the basis of the degree of integration, intervention required and cultural change for the acquisitions to be able to meet the objectives. The three categories are associated with industry focus, firms’ relative autonomy and size.

-

Acquiring firms can be done either using cash or stock or even the combination thereof. The acquiring firms prefer using cash when it is the stocks which are undervalued and use stocks when the stocks of the firm have a higher value (Buckley et al., 2010).

2.1.2. Types of acquisitions

a) Cash Acquisitions

-

Researchers have presented that cash acquisitions positively affects the acquiring firms' performance. The incentives are created by cash acquisitions for the acquiring firms. This is due to the result of diligently managing processes and the synergy. In addition, the acquisitions done through cash are considered to be positive (Edwards, Kravet & Wilson, 2016).

-

Investors invest when having an indication that the firm would be able to derive economic gains over what the deal costs.

b) Stock Acquisitions

-

This acquisition mode is related to negative responses from the market. It was stated by Gubbi, Aulakh, Ray, Sarkar and Chittoor (2010) that incorrect pricing results in incentives as acquiring firms would be able to overvalue stocks at hand. By introducing manipulations in the earnings, the firms might be able to acquire others more cost-effectively with their overvalued stocks. It is; therefore, managers can be found to be being cautious about the medium of payments and would stick to choosing stock acquisitions when their firms’ stocks are being overvalued.

2.2 Greenfield

The FDI for the greenfield investments begins with base and then grows from there. Companies like Starbucks, McDonald’s and Coca Cola serve as great examples of firms in the US which have invested in projects of greenfield. Through this investment, the investors are able to achieve increased production scope, better transportation and purchasing, improved research and development and better marketing and financial terms (Cambazoglu & Simay-Karaalp, 2014)

Advantages of greenfield investments:

-

Greater control on different business aspects for the investor

-

Ability to implement best strategies by the investor

-

Often times available for Vendor financing

-

The commitment to market will be solid.

-

The ability for the investor to work along with respective authorities from the start

-

Must control over the brand

-

Opportunities in press media

Greenfield has some disadvantage which might result in the investor not choosing the FDI. This is:

-

The starting costs are likely to be more are it would be difficult to overcome them with competitive nature as it would take at least one year to enter the market effectively. In addition, barriers to the entry would pose a high cost. Moreover, multinational enterprises might receive a disadvantage due to regulations set by the government for the short term (Eberhard, 2011).

2.3 Recommendation

Acquisitions are only sensible when the outcomes are favouring the target party’s shareholders along with the involved acquiring firms. The argument here is that whether or not a competitive advantage of the involved firms is enhanced by the deal, as not would result in positive outcomes. On average, the shareholders of target firms experience positive returns which is an indication of potential acquisitions which might be of shareholder’s interest. Greenfield investments are valuable when considering building new enterprises in a country and since it depends on the environment of the county itself, it cannot be recommended in South Africa. Building new organisation in a market where there is a lack of skilled workforce, lack of assurance of safety and increasing corruption, there are too many risks involved. Investing in a pre-existing and stable company is more suitable in the case of South Africa and is recommended as well

Part 3: Risk Management

3.1 Issue of unemployment

There is a high unemployment rate in SA. To address this, the SA government has adopted an empowerment policy, ‘broad-brand black economic’. Due to a great business association, the government in SA is at high stakes of risks. In addition, lack of employed individuals, the growth of the various organisations is halted which ultimately impacts the growth of the country. Moreover, education quality or lack thereof is associated with the employment rate. Therefore, high unemployment could be an indication of poor education services for the people of South Africa thus affecting the skills and employability of the individuals (Van der Berg & Van Broekhuizen, 2012).

3.2 Issue of FDIs

Now, although South Africa has high potential attractiveness when compared to other African countries, its state with respect to attracting FDI is relatively weak. According to the World Investment Report of 2018 published by UNCTAD, it was presented that there was a contraction of 41% in the inflow of FDI for the year 2016-2017 (UNCTAD, 2018). In terms of FDI received, South Africa stands at 568th position as of 2017. The reason for this is that the demand in the domestic areas is below than what the investors expect. Another report published by World Bank in 2019 was that South Africa is ranked at the 82nd position in terms of doing business out of the 190 other economies. In addition, although the country has great assets which would attract foreign investors such as the plethora of natural resources, workforce, transparent legal system and so on, there are issues of corruption, high crime rates and also the structural issues. This works negatively as it highly discourages them to invest in the country. Moreover, the investors are also worried regarding the clarity which is lacking in the country’s structural reforms and policies.

4.0 Reference

Alfaro, L., & Chauvin, J. (2016). Foreign direct investment, finance, and economic development. Chapter for the Encyclopedia of International Economics and Global Trade, Forthcoming.

Bouwfonds Investment Management. (2016). Fibre-optics: 21st century communication backbone. Retrieved from http://www.bouwfondsim.com/wp-content/uploads/2017/06/Fibre-optics-21st-century-communication-backbone.pdf

Buckley, P. J., Clegg, L. J., Cross, A., Liu, X., Voss, H., & Zheng, P. (2010). The determinants of Chinese outward foreign direct investment. In Foreign Direct Investment, China and the World Economy (pp. 81-118). UK: Palgrave Macmillan.

BusinessTech. (2016). This is who is emigrating from South Africa – and where they are going. Retrieved from https://businesstech.co.za/news/government/131802/this-is-who-is-emigrating-from-south-africa-and-where-they-are-going/

Cambazoglu, B., & Simay Karaalp, H. (2014). Does foreign direct investment affect economic growth? The case of Turkey. International Journal of Social Economics, 41(6), 434-449.

Chavula, H. K. (2013). Telecommunications development and economic growth in Africa. Information Technology for Development, 19(1), 5-23.

Cock, C. (2015). Influence of strike action on South Africa s credit rating by global rating agencies (Doctoral dissertation, University of Pretoria).

Darley, W. K. (2012). Increasing Sub-Saharan Africa's share of foreign direct investment: Public policy challenges, strategies, and implications. Journal of African Business, 13(1), 62-69.

Darley, W. K. (2012). Increasing Sub-Saharan Africa's share of foreign direct investment: Public policy challenges, strategies, and implications. Journal of African Business, 13(1), 62-69.

Deloitte. (2014). The future of telecoms in Africa: The “blueprint for the brave”. Retrieved from https://www2.deloitte.com/content/dam/Deloitte/fpc/Documents/secteurs/technologies-medias-et-telecommunications/deloitte_the-future-of-telecoms-in-africa_2014.pdf

Denisia, V. (2010). Foreign direct investment theories: An overview of the main FDI theories. European journal of interdisciplinary studies, (3).

Dholakia, R. R., & Kshetri, N. (2004). Factors impacting the adoption of the Internet among SMEs. Small Business Economics, 23(4), 311-322.

Eberhard, A. (2011). The future of South African coal: Market, investment and policy challenges. Program on energy and sustainable development, 1-44.

Edwards, A., Kravet, T., & Wilson, R. (2016). Trapped cash and the profitability of foreign acquisitions. Contemporary Accounting Research, 33(1), 44-77.

Gubbi, S. R., Aulakh, P. S., Ray, S., Sarkar, M. B., & Chittoor, R. (2010). Do international acquisitions by emerging-economy firms create shareholder value? The case of Indian firms. Journal of International Business Studies, 41(3), 397-418.

Helmoed-Römer, H. (2019). South African defence budget points to military, industrial decline. Retrieved from https://www.janes.com/article/86920/south-african-defence-budget-points-to-military-industrial-decline

Hodge, J. (2000). Liberalising communication services in South Africa. Development Southern Africa, 17(3), 373-387.

James, J. (2011). Sharing mobile phones in developing countries: Implications for the digital divide. Technological Forecasting and Social Change, 78(4), 729-735.

Jobodwana, Z. N. (2009). E-commerce and mobile commerce in South Africa: regulatory challenges. J. Int'l Com. L. & Tech., 4, 287.

Kalba, K. (2008). The adoption of mobile phones in emerging markets: Global diffusion and the rural challenge. International journal of Communication, 2, 31.

Kyobe, M. (2011). Investigating the key factors influencing ICT adoption in South Africa. Journal of systems and information technology, 13(3), 255-267.

Langmia, K. (2006). The role of ICTs in the economic development of Africa: The case of South Africa. International Journal of education and Development using ICT, 2(4).

Manolova TS, Eunni RV and Gyoshev BS (2008) Institutional environments for entrepreneurship: evidence from emerging economies in Eastern Europe. Entrepreneurship Theory and Practice 1(2), 203–218.

Ngwenya, M. (2017). Achieving a Sustained Competitive Advantage in the South African Telecommunications Sector. Universal Journal of Management, 5(6), 278-290.

Nwonwu, F. O. C. (2016). The paradox of natural resource abundance and widespread underdevelopment in Africa. International Journal of African Renaissance Studies - Multi-, Inter- and Transdisciplinarity, 11(2), 52–69.

Olawale, F., & Garwe, D. (2010). Obstacles to the growth of new SMEs in South Africa: A principal component analysis approach. African journal of Business management, 4(5), 729-738.

Rose-Ackerman, S., & Palifka, B. J. (2016). Corruption and government: Causes, consequences, and reform. UK: Cambridge university press.

Roycroft, T. R., & Anantho, S. (2003). Internet subscription in Africa: policy for a dual digital divide. Telecommunications Policy, 27(1-2), 61-74.

Saleem, R., Mahmood, A., & Mahmood, A. (2010). Effect of work motivation on job satisfaction in mobile telecommunication service organizations of Pakistan. International journal of business and management, 5(11), 213.

SARS. (2019). Tax statistics. Retrieved from https://www.sars.gov.za/About/SATaxSystem/Pages/Tax-Statistics.aspx

Sertyesilisik, B. (2016). Embending sustainability dynamics in the lean construction supply chain management. YBL Journal of Built Environment, 4(1), 60-78.

STATS SA. (2016). Key statistics. Retrieved from www.statssa.gov.za

Tuomi, K. (2011). The role of the investment climate and tax incentives in the foreign direct investment decision: evidence from South Africa. Journal of African Business, 12(1), 133-147.

UNCTAD. (2018). World investment report 2018. Retrieved from http://unctad.org/en/PublicationsLibrary/wir2018_en.pdf

Urban, B. (2018). The influence of the regulatory, normative and cognitive institutions on entrepreneurial orientation in South Africa. The International Journal of Entrepreneurship and Innovation, 146575031879672.

Van der Berg, S., & Van Broekhuizen, H. (2012). Graduate unemployment in South Africa: A much exaggerated problem. Centre for Development and Enterprise, Stellenbosch University.

Get It Done! Today

1,212,718Orders

4.9/5Rating

5,063Experts

Highlights

- 21 Step Quality Check

- 2000+ Ph.D Experts

- Live Expert Sessions

- Dedicated App

- Earn while you Learn with us

- Confidentiality Agreement

- Money Back Guarantee

- Customer Feedback

Just Pay for your Assignment

Turnitin Report

$10.00Proofreading and Editing

$9.00Per PageConsultation with Expert

$35.00Per HourLive Session 1-on-1

$40.00Per 30 min.Quality Check

$25.00Total

Free- Let's Start